In 2018, in the 24 Las Vegas “Big Strip Casinos”—those generating more than $72 million of gaming revenue—non-gaming revenue made up more than 65 percent of total revenue. By contrast, in 1990, non-gaming revenue comprised just over 40 percent of total revenue on the Strip.

Hardly an accident, this shift in revenue mix is the result of a concerted effort by Las Vegas resorts to emphasize that Las Vegas isn’t just for gambling. With the proliferation of regional markets, many customers can now gamble near home. But Las Vegas is more. When you come to Las Vegas, you come for the experience. The restaurants. The shows. The clubs. The sin that made Sin City famous. And hey, since you’re here, maybe you’d enjoy trying your hand at one of our fine games of chance.

Indeed, despite the expansion of legal commercial and tribal gaming into more than 40 states, Las Vegas has weathered the storm (and a global recession). McCarran Airport continues to see record numbers of passengers, and resort revenues have never been higher.

It should come as no surprise, then, that casinos and resorts across the country are seriously evaluating their amenities offerings. Even—maybe especially—outside of Las Vegas, properties are looking to diversify their offerings, differentiate themselves from competitors, attract new guests, and give their existing guests renewed reasons to visit. They are finding these reasons in the form of new and updated experiences, many of which reside off the gaming floor.

A core component of our business is consumer research, and another is helping clients perform highest and best use assessments for land parcels or underutilized areas of casinos and resorts. We’ve found blending the two—surveying guests when assessing best use of space—to be highly informative. Seeking the voice of the customer in these projects has resulted in several unique and successful outcomes. With that in mind, we conducted a survey of 500 adults who visit casinos so that we could share actual player views in this article. We asked respondents several questions about their perceptions, opinions, and usage of amenities, and we share some of the highlights here.

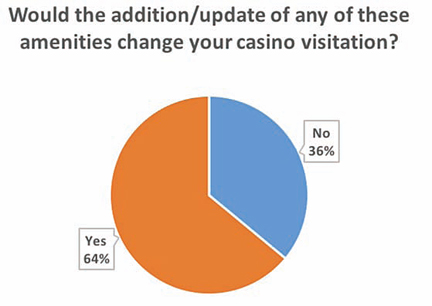

We asked our survey respondents whether the addition or refresh of certain amenities would change their casino visitation. Only 36 percent of respondents said “none of the above.” In other words, 64 percent of respondents claim they would change their casino behavior based on amenity addition, an indication that our guests are looking for newer, better, more exciting things from us, and we have an opportunity to drive our core business by providing them the experiences they want.

The Resort Pool

One of the first things we asked in our survey was the top reasons respondents visit their local casinos. Not surprisingly, gambling and dining took the top two places. Entertainment (shows, concerts, etc.) and retail/shopping tied for third.

However, when we asked about the reasons respondents visit Las Vegas casinos, we saw additional amenities become significant. Gaming, dining and entertainment again occupied the top three positions, with shopping following in fourth. Shopping was immediately followed by pool/spa and sportsbook.

Understandably, the caliber of the entertainment in Las Vegas is much higher than that at a regional casino, and it makes sense then that entertainment might distance itself from retail. But the addition of the pool, spa and sportsbook suggests opportunities for regional casinos to provide experiences that guests are seeking when they visit Las Vegas. Las Vegas’ weather makes for a lengthy pool season, and its nightclub-centric visitation allows for the transformation of a “pool” into a “day club.”

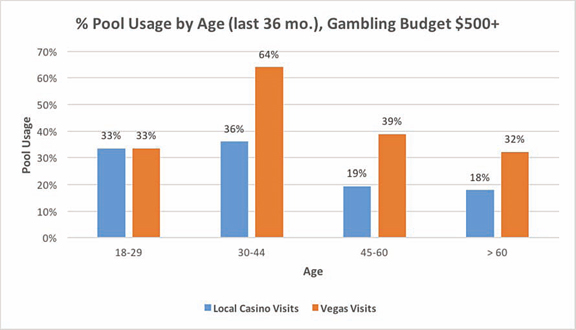

But looking at the large disparity between those who had used the pool on a trip to a Las Vegas casino in the last three years and those who had used the pool on a trip to a casino locally in the last three years, we see an opportunity to provide a higher-caliber, resort-oriented pool experience at larger regional casinos.

For the chart below, we restricted to “core” gaming guests, those whose daily gaming budget exceeds $500 (we expect a $500 budget to approximate $100-$200 ADT). We expected to see a gap in the younger crowd, those whom we know are drawn to the experiential pool parties in Las Vegas. Surprisingly, what we actually see is a gap in the 30-plus crowd, a gap that extends to even our oldest guests.

Sportsbook

With the Supreme Court’s overturn of PASPA in 2018, sports betting has been at the forefront of gaming expansion nationwide. Sportsbooks are a viable amenity today in several states, and within the coming years we expect more than half of U.S. states to legalize the game. We see vast interest in sports betting.

In prior work on the topic, we found 40 percent of respondents likely to make at least one sports wager in the next 12 months if it were legal, regulated, and accessible in their area. While this may seem high, we’ve spoken to many seemingly unlikely bettors who say they’d bet on their college team’s rivalry game, on a game they are attending, on the Super Bowl, on an NCAA tournament bracket contest, and so on.

Additionally, in the current survey, 18 percent of respondents list sports betting as one of their top three reasons to visit a Las Vegas casino, and 4 percent of respondents identified sports as their primary form of gaming when they visit Las Vegas. Sports bettors skew younger and male, a decidedly different demographic than the traditional slot player. And with the bulk of the betting volume being mobile (where allowed), sportsbooks are truly amenities and should be designed as such.

Movies and Bowling

I live in Las Vegas. In typical Las Vegas fashion, the movie theaters and bowling alleys I go to are in casinos. Movies and bowling are usually a family outing for me, so they aren’t accompanied by gaming. On the other hand, I do take into account my ability to earn and burn comps when selecting my destination, thereby tying my movie theater and bowling decisions into my gaming decisions.

This didn’t resonate with the survey respondents, however, when we asked about their behaviors and expectations. Only 12 percent had been to a movie at a casino in the last three years, and only 8 percent had bowled at a casino. Moreover, only 16 percent expected a casino to offer a movie theater, and only 12 percent expected a bowling alley. Even fewer expected that they’d be able to use comps on movies and bowling.

Echoing my own experience, less than 5 percent of moviegoers and bowlers reported being likely to game on the same trip. While this doesn’t make movie theaters or bowling alleys poor choices of amenities to add, it increases the need for a strong integration with the loyalty program to

really make the connection between gaming and the amenity. Programming the outlet with adult-only events may also increase the gaming crossover.

Dining

In the age of the celebrity chef, we’d be remiss not to discuss dining as an amenity, and the survey delivered a few interesting findings. First, we asked about “food court”-type dining, “sit-down casual,” and “fine dining,” in an effort to avoid the more common industry terms like QSR and fast casual. Thirty of the 500 respondents informed us via free response that we had omitted “buffet” as an option, and they felt that a buffet was an important part of their casino experience. While 6 percent sounds small, it is a very large number to agree unprompted via free response, which many respondents skip anyway. Casino-goers love a good buffet.

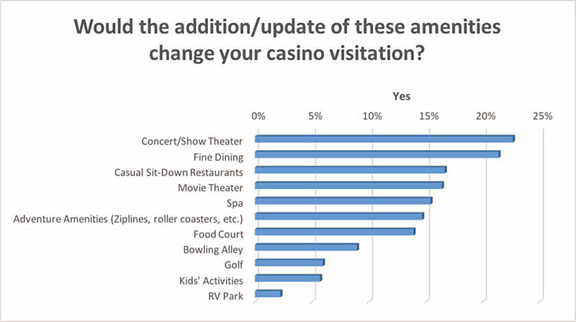

Additionally, when asked whether the addition or update of dining options would cause respondents to change their casino visitation, 21 percent said that fine dining additions/updates would change their visitation. The trend of celebrity-branded restaurants and experiential dining resonates in a casino environment. Slightly fewer, 17 percent, said that casual sit-down restaurant additions/updates would change their visitation. This gives the indication that even a refresh of existing F&B concepts may provide some re-energizing of the database. We compare these values to a sample of other amenities in the chart above.

Lastly, when asked why they eat at the casual restaurants in a casino, 52 percent cited “convenience (I was already at the casino),” 36 percent cited the ability to use comps, and interestingly, 32 percent cited “ability to gamble before or after.” In other words, nearly a third of casino restaurant-goers are coupling their dining decisions with their gambling decisions. Instead of a local restaurant, they are driving to the casino for the restaurant-casino combination, when they may not otherwise have gone to the casino or the restaurant. Less than 15 percent cited proximity to their homes as a driver.

Amenities of the Future

We tried to get a sense of some outside-the-box amenities that our survey respondents would like to see. Suggestions ranged from theme parks to dispensaries/cannabis lounges, the latter being suggested several times. Activities for kids were often cited as desirable as well. Only 8 percent of respondents expressed interest in seeing an esports arena, but this number is around half of the number that expressed interest in a sportsbook, which we thought was impressive given that there is clearly wider recognition and understanding of the latter than the former.

Not surprisingly, interest in esports degrades with age, from 16 percent in the 26-35 age range to only 2 percent among those 60-plus. Somewhat surprisingly, we found no significant differences in gender interest in esports, with 8 percent of our female respondents and 9 percent of our male respondents expressing interest.

Around 13 percent of respondents expressed interest in TopGolf, compared to only 10 percent of respondents that reported golfing at a casino and just over 5 percent that said the addition of a golf course would change their visitation. Today, we’re seeing not only full TopGolf facilities but TopGolf Swing Suites at several major casinos throughout the country.

Swing Suites provide a TopGolf experience on a simulator for private, indoor, all-weather enjoyment that can be integrated into a bar or lounge. This provides a more rounded entertainment environment for the golfers while generating interest in the product from other bar-goers.

Another amenity we asked about was the “anti-nightclub”—a bar, lounge, or social space that serves as a complement to an ordinary nightclub, instead providing a lower-key, more intimate atmosphere. A whopping 35 percent of respondents expressed interest in such a space, with one even remarking that “I enjoyed that ‘anti-nightclub’ option for sure! I love the idea of more lounge areas and low-key bars at a casino. Nightclubs are generally too loud and crowded and not my favorite. I would like having more intimate options.”

So, What’s Next?

I’m often asked what it’s like to live in Las Vegas. Implicit in the question is always a tone of “How can you deal with the Strip all the time?” And as every Las Vegas local has politely done a thousand times, I explain that Las Vegas is a beautiful Mountain West city that just happens to have a pretty well-known tourist district, one that really doesn’t affect me on a day-to-day basis.

Sure, we do occasionally visit the Strip for a nice dinner or to meet friends visiting town. We go to TopGolf. We take the kids on the monorail, to the shops, or to see the Bellagio Fountains. We see a headlining comic.

But more often, we go to local casinos to gamble, to watch movies, to bowl, to have dinner, even to have a Jeopardy! watch party in the bar and cheer on our friend James. We enjoy the amenities. We get into routines, and we build loyalty to the casinos we enjoy—they become our casinos. But, allegiance can be fickle. New restaurants open. The new movie theater has wide seats and beverage service. It’s 115 degrees outside—did you hear about the new Swing Suite?

So, what does this all mean? With the plethora of casino and resort options, guests require thoughtful updates and innovation to stay loyal. As casinos and resorts seek to provide the latest and greatest amenities to their guests, the winners will be those that stay ahead of the curve, the ones that adeptly mix the latest and greatest with the tried-and-true classics.